Interest in the concept of ESG (English acronym for Environmental, Social and Governance – in Portuguese, Environmental, Social and Governance - ASG) has increased year by year as a reflection of the growing participation of investors to project analyses based on these themes. According to the website Google Trends, the term is at the height of its popularity among users of the search site worldwide. Brazil follows a similar trend.[1]

The acronym ESG designates a method of analysis of investments in which, in addition to the traditional variables (risk, return and liquidity), environmental, social and corporate governance aspects and risks are considered in decision making. The adoption of such criteria is a paradigm shift for investment decisions and financial strategy, which incorporate practices traditionally associated with sustainability and social issues.

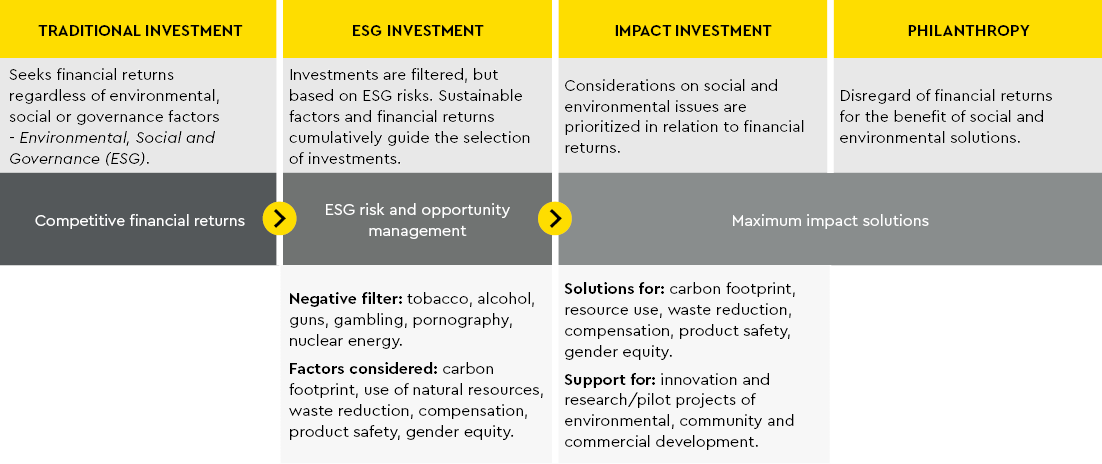

The way such aspects are incorporated into the investment methodology varies by investor or company. In general, the objective of ESG investments is not to generate impact and a positive social solution, but rather to consider the risks related to such themes and minimize them. For this reason, not every ESG investment can be considered an impact investment.

As its name implies, impact investments are explicitly intended to generate positive results from a social and environmental point of view, in addition to ensuring financial return. They can use ESG criteria cumulatively and complementaryly, and their impacts are often measured and evaluated periodically.[2]

Source: Prepared on the basis of Evolution of an Impact Portfolio: From Implementation to Results, produced by Sonen Capital.

The following diagram simply summarizes different investment structures:

The following table summarises, in a non-exhaustive way, some aspects taken into account in the analysis of an ESG investment:

| ENVIRONMENTAL | Issues related to the preservation, recovery and functioning of the environment and natural resources: ▪ Generation or use of renewable energy sources ▪ Energy efficiency gains ▪ Basic sanitation and waste management |

| SOCIAL | Issues related to the rights and interests of individuals and communities: ▪ Attention to human rights ▪ Enforcement of labor rights and employee relations ▪ Promoting measures to encourage diversity and equal treatment ▪ Relations with local communities ▪ Activities in conflict zones ▪ Health promotion |

| CORPORATE GOVERNANCE | Issues related to the corporate governance of invested companies, other invested entities and their suppliers: ▪ Creation of councils and supervisory bodies ▪ Promoting diversity measures in management frameworks ▪ Disclosure of information ▪ Interactions with related parties ▪ Mechanisms for allocating competences and responsibilities for management ▪ Adoption of ethical standards ▪ Adoption of business strategies that take into account environmental and social criteria ▪ Promotion of best social and environmental and anti-corruption practices internally and externally (with customers and suppliers) |

Source: The emerging financial market verdes in Brazil, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ).[4]

Financing entities such as development banks (National Bank for Social Development – BNDES, Banco do Nordeste – BNB, among others), multilateral agencies (World Bank, International Finance Corporation – IFC and Inter-American Development Bank – IDB), export credit agencies and commercial banks already include conditions related to ESG aspects in their investment and financing operations. In such cases, the adhering to ESG principles and the obligation to maintain and observe such principles throughout the duration of the funding are usually essential conditions for defining whether the project will receive funding from the bodies concerned. The form and periodicity of monitoring and monitoring of such adement vary according to the funding entity, but many of them have specific departments to do such monitoring.

Companies can also adhere to ESG principles on their own, regardless of the requirement of third parties or funders. In these cases, they seek certifications specific to their activities, their debt securities and/or projects to be financed.

Certifications can be based on various criteria, both environmental and social, and are tied to the issuers and their projects in which the resources will be used. The Green Bonds Principles and the Climate Bonds Initiative (CBI) are examples of criteria for issuing these certifications for green bonds. Green bonds (or green bonds) are debt securities used by issuers to raise funds for the purpose of implementing or refinancing projects or assets, new or existing, that have positive environmental or climatic attributes (generally defined as green projects) and recognized by a certifying entity.

Based on the Paris Agreement on greenhouse gas emission reduction measures to curb the planet's rising temperature, the CBI proposed common and broad definitions on what should be considered "green" in eight priority sectors in order to standardize and support the growth of a cohesive and consistent global market of green bonds. The sectors are: energy, transportation, water, buildings, land use and marine resources, industry, sewage and waste management, and information technology.[5]

Thus, the CBI created the Certification Scheme of the Climate Bonds Initiative, which establishes the Sector Criteria of the System of Standards and Certification of Climate Bonds, presenting proposals for conditions and eligibility limits that companies and their projects and debt securities must meet in order to be considered green.

Project developer companies can also finance them by issuing encouraged debentures. Law No. 12,431/11 consolidated a privileged tax regime in relation to assets and financial instruments for long-term financing with regard to projects in certain infrastructure and securities sectors that meet some specific requirements.

In relation to the debentures of incentorsins, Law No. 12,431/11 was regulated by Decree No. 8,874/16, which determined that investment projects aimed at the implementation, expansion, maintenance, recovery or modernization of infrastructure projects in the logistics and transportation, urban mobility, energy, telecommunications, broadcasting, basic sanitation and irrigation sectors, as well as projects that provide relevant environmental or social benefits, can be framed as priority projects by the competent ministries for the purpose of issuing such securities.

The encouraged debentures provide some holders with tax benefits for the financing of the project, which, depending on their nature, may or may not be considered green or social and, therefore, subject to environmental and social certifications (such as those of the CBI or Green Bonds Principles) and attract even more investors.

With the increasing support of investors and funders to ESG analyses, the option of obtaining environmental and social certifications should become even more recurrent in project financing structures. In addition, such certifications may be obtained for encouraged debentures in order to increase investor interest in assets that accumulate ESG characteristics and a differentiated financial return.

[1] Google Trends. https://trends.google.com.br/trends/explore?date=today%205-y&q=%2Fm%2F0by114h and https://trends.google.com.br/trends/explore?date=today%205-y&geo=BR&q=%2Fm%2F0by114h . Access on: 10 Mar. 2021.

[2] XP Expert. Impact Investment & ESG: the return of a better world. https://conteudos.xpi.com.br/alternative-week/live/investimento-de-impacto-esg-o-retorno-de-um-mundo-melhor/

[3] Sonen Capital. Evolution of an Impact Portfolio: From Implementation to Results. http://www.sonencapital.com/thought-leadership-posts/evolution-of-an-impact-portfolio/#:~:text=The%20report%2C%20titled%20Evolution%20of,social%20and%20environmental%20impact%20results.

[4] Chalk. The emerging green finance market in Brazil. http://www.labinovacaofinanceira.com/wp-content/uploads/2020/07/mercado_financasverdes_brasil.pdf

[5] Cbl. Climate Bonds Taxonomy. https://www.climatebonds.net/standard/taxonomy