Brazil stands out in the international market as one of the main exporters of agricultural products in the world. In 2020, agribusiness represented 26.6% of the Brazilian GDP.[1] Climate and soil conditions have become major attractions for foreign investments in rural activities conducted in the country. The problem, however, is that Brazilian legislation provides for restrictions on the acquisition and leasing of rural properties by foreign companies or individuals authorized to operate in Brazil.

The restrictions on the acquisition of rural properties by foreign individuals or legal entities and the persons treated thereto are provided for in Federal Law No. 5,709/71 and Decree No. 74,965/74. In addition to regulating the conditions that allow this acquisition, the two rules stipulate the need for a prior procedure to obtain authorization for the business that involves acquisition of rural properties.

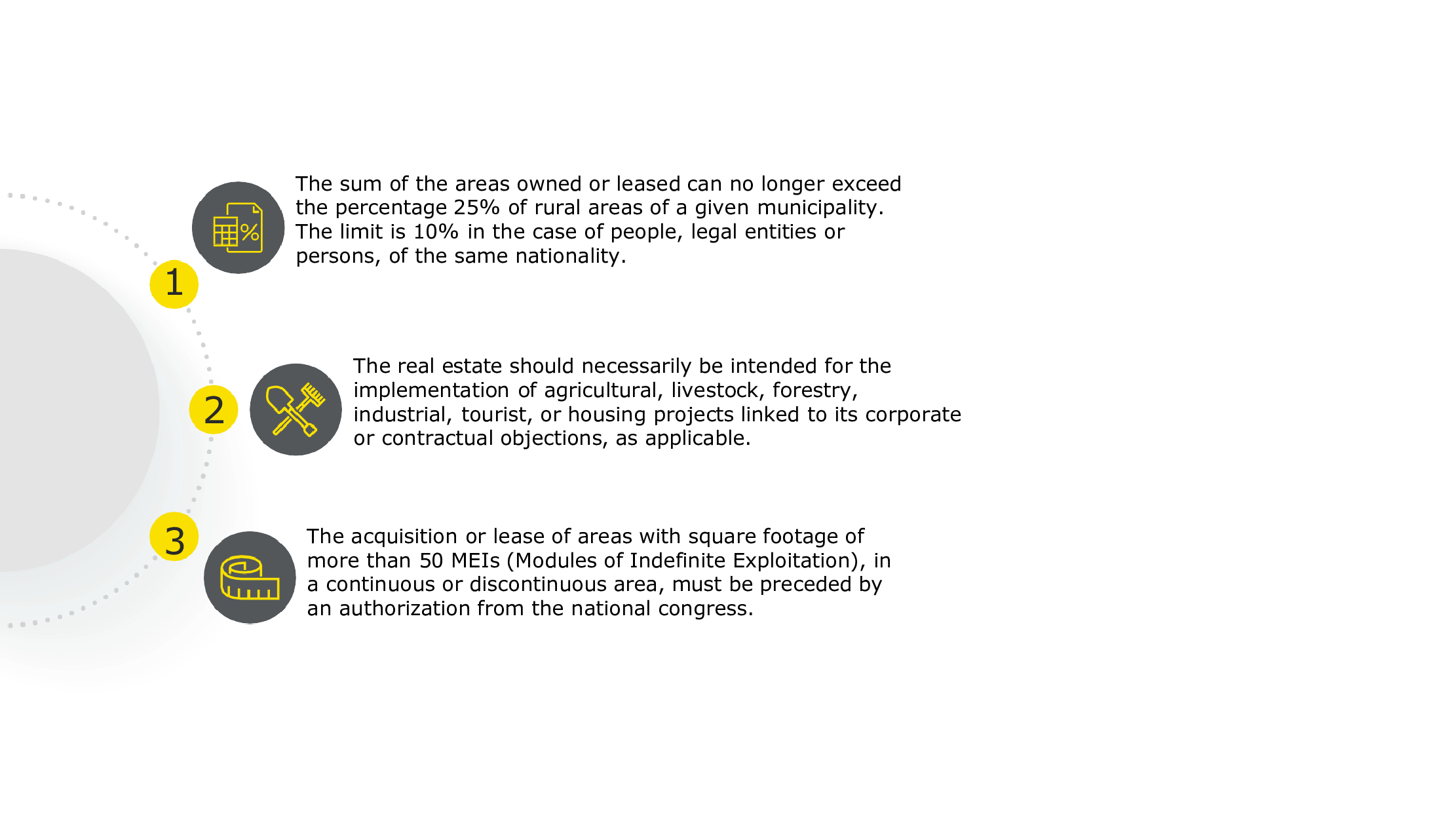

Among the restrictions brought in by the legislation, the following limiting parameters stand out:

The discussions began when Federal Law No. 5,709/71, in its article 1, paragraph 1, extends such limitations to Brazilian companies that have foreign control, equating them to foreign companies and individuals for the purpose of acquiring rural real estate.

Much was discussed regarding the applicability of this law to Brazilian companies with foreign control, especially after the entry into force of the Federal Constitution of 1988, since some legal scholars believed that the new Constitution had not adopted paragraph 1 of article 1 of the law.

However, in 2010, the Federal Attorney General's Office issued opinion AGU LA 01/10 through which it recognized the possibility of applying restrictions to Brazilian companies with foreign control.

The prior authorization procedure for the acquisition or lease of rural properties is carried out by Incra, which, in turn, established in Normative Instruction No. 88/17 and its subsequent amendments the process for foreigners to obtain authorization for the acquisition of rural property, which includes evaluation of compliance with legal requirements, permitted percentages, location of the properties, and plan for the operation of the areas.

The request for this authorization is a complex procedure, which, in some cases, may require approval by the Brazilian Congress. The often time-consuming procedure does not meet the agility of the market, especially when the acquisition of rural property by a foreigner takes place in the context of corporate transactions, such as mergers and acquisitions, or stock exchange trades, which are also subject to the scrutiny of federal law. In addition, purchases made in non-compliance with the legislation may be declared null and void at any time, so that all acts subsequently committed lose their legal validity.

In this context, and considering that, in order to obtain financing, licenses, and authorizations necessary for the development of activities, it is necessary to present/prove the relationship with the property to be used, various institutes are used as an alternative to acquisition via sale and purchase or lease, to allow Brazilian legal entities equated to foreign entities to use rural properties in the conduct of their economic activities.

Among the possible alternatives, such as corporate structures that rule out the establishment of foreign control and disqualification as rural properties, there are other real estate rights that may be constituted on real estate and do not imply transfer of ownership, modalities of contracts, among others. They need to be checked on a case-by-case basis, after careful study of the activity that is intended to be conducted, of the company that intends to acquire such rights, and the target property.

A widely explored option in alternative models is the creation of surface rights. It is a real property right, enforceable against third parties, which presupposes the unfolding of full ownership between the owner and the holders of surface rights. The first follows as holder of the property, but in a limited way, since use and possession are exercised by the surface rights holder.

The surface rights holder then has broad power over the object, and is able to exploit it as it sees fit and within the limits set with the owner of the property, in a manner similar to a lease.

The creation of the surface right is mandatorily by means of public deed (even if free of charge), which must be submitted for recording in the registration of the property. ITBI is levied on the acquisition, assignment, and cancelation of the surface right. It is necessary to confirm the tax rate in the municipality where the property is located.

Surface rights were reintroduced into the Brazilian legal system by the Civil Code of 2002 and the City Statute in 2001, that is, when Federal Law No. 5,709/71 and Federal Law No. 8,629/93 were enacted, it was not possible to insert a prohibition on the use of this institute by foreigners and those equated thereto, since it did not exist in the Brazilian legal system.

Although surface rights are not expressly covered by Federal Law No. 5,709/71 and, therefore, are not subject to the restrictions imposed by it thus far, Incra has already indicated that it intends to monitor transactions for acquisition of surface rights carried out, because it believes that the matter may be subject to restrictions in the future.

In Incra’s analysis, surface rights resemble a lease, which has restrictions provided for by law, but the two institutes are distinct. A lease expresses an agreement of will between the parties, on a mandatory basis, and rural lease are necessarily for charge, while surface rights are real property rights, enforceable against third parties and which may be without charge.

The similarities between lease and surface rights are only in the occurrence of delivery of the property to a third party, who, in fact, will be responsible for exploiting or using it, without transfer of ownership. However, the two institutes are distinct and cannot be equated for the purposes of applying the restrictive measures imposed by Federal Law No. 5,709/71.

The restriction of rights must be preceded by legal regulation of the matter, in compliance with the principle of legality, provided for in the Federal Constitution. The application of restrictions on the establishment of surface rights on rural properties in favor of foreign and/or equated surface rights is lacking in legal regulations.

Despite the absence of legal regulation to this effect, it is common for officials of registry offices of deeds and real estate to resist the drafting or recording of deeds for the creation of surface rights, as they are aware of the penalties applicable in the event of drafting of deeds dealing with rights on rural properties and legal entities equated to foreign entities without compliance with the provisions of law.

Although there is no express legal prohibition or even a specific administrative procedure to examine cases of creation of surface rights, before choosing this structure, it is recommended that one consult whether there is position on the part of the responsible person with Judicial Internal Affairs.

Another alternative structure used to enable the use of rural properties is assignment of the right of use, a contract of a personal nature that resembles a lease governed by the Civil Code. It allows the owner to assign the use of a property, for a specified period, upon payment of monthly rent. For that reason, it is not a question of a real property right, but a personal right between the parties.

This structure is widely accepted by banking institutions. For this reason, it is common to require recording or registration of the instrument in the registration of the property, thus ensuring public notice of the transaction. The Judicial Internal Affairs Offices of some states, such as Bahia, have already taken the position that one must require that assignment of use must be formalized through a public instrument.

The assignment of the right of use is not to be confused with the granting of the right of use, a dissolvable real property right usually used in relations between individuals and entities of the public administration.

In order to provide security to foreign investors and to the operations maintained by them in Brazil, it is essential to carry out planning and a prior study of possible legal alternatives based on an analysis of which structures best suit the development of the activities intended.

There are bills in progress that discuss the restrictions applicable to foreigners and, in particular, their application to companies equated to Brazilian companies, with emphasis on Bill No. 2,963/19, which was approved at the end of 2020 by the Federal Senate and merits monitoring due to the changes it intends to bring about for the topic.

[1] Source: Center for Advanced Studies in Applied Economics - ESALQ/USP.