In recent years, incentives for electric and electrified vehicles, such as hybrids and plug-ins, have become increasingly common. This is because these vehicles are seen as a way to tackle the climate crisis by reducing greenhouse gas emissions.

In the state of São Paulo, for example, the Pro Green Vehicle program, created in March of 2022, aims to encourage the development of industrial companies assembling less polluting motor vehicles through the immediate monetization of accumulated ICMS credits. For commercial companies of this type of vehicle, the São Paulo state government reduced the ICMS tax levied on the marketing and sale of trucks, buses, and electric and electrified vehicles from 18% to 14.5% as of January of this year.

The market for electric and electrified vehicles is tending to become even more consolidated, as pointed out in the report by the UN Conference on Trade and Development (UNCTAD), which estimates an almost 500% growth in the production of electric cars by 2030.

However, despite the growing stimulus to the production, marketing, and sale of electric and electrified vehicles, it is noted that the tax treatment of the commercial recharging of these vehicles has not received due attention. Before analyzing the possible tax effects of recharges, it is worth clarifying some relevant technical issues about these operations.

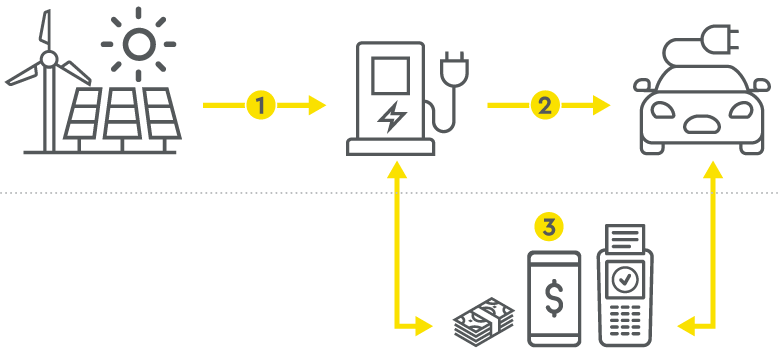

Broadly speaking, the charging process for electric and electrified vehicles follows the following flow:

- The electricity supplier (distributors, in the case of captive consumers of electricity, or generators/traders, in the case of electricity contracted in the Free Contracting Environment - ACL) feeds the load stations with electricity.

- The Charge Point Operator (CPO), commonly called an electric station, offers consumers electric charging from chargers (wallbox or electric pump), with other additional services, such as the possibility of remote station reservation, information about free terminals and charging power, payment methods, etc.

- To facilitate the management of the various issues associated with recharging, the electric station can operate recharges through an e-Mobility Service Provider (eMSP), which brokers recharging - with the management of additional services via the platform - and payment of the recharge. In this situation, the eMSP enters into the contract with the consumer and releases to the consumer the recharge and other service components received from the charging station.

Regarding the remuneration for recharges, the price charged generally consists of a basic fee per charge plus a variable fee per volume (per kWh) or per charge time (per hour or minute). However, it is common for large supermarket chains, shopping centers, and office buildings to also offer free charging of vehicles during the customers' stay, as a form of attraction.

Considering the above scenario, a number of relevant questions arise regarding the tax treatment of electric vehicle recharging activities, which may become even more complex if the eMSP is also involved in the recharging supply process.

In particular, there is a lot of uncertainty regarding the levying of ICMS and ISS on the charging activities of electric vehicles. The uncertainty lies especially in the qualification of the recharging activity as a service, taxable by the ISS, or as a form of electricity trading, taxable by the ICMS.

At first sight, we believe it would be defensible to qualify electric vehicle recharging activities as a service, of which electricity would be an input. This perspective is based on the fact that consumption of the electric energy used for recharging is done by the charging station (which uses this input to provide its recharging service).

In other words, the charging station would act only as a consumer unit of the electricity supplied by the distributor, generator, or trader, and the electricity trading cycle for ICMS purposes would end there.

Supporting this interpretation, the chairman of the National Agency of Electric Energy (Aneel), when approving Aneel Normative Resolution 819/18 - which regulated electric vehicle recharging activities - expressed the understanding that "the recharging of electric vehicles is characterized as a distinct service, which uses electricity as an input.

Although the resolution was revoked by Aneel Normative Resolution 1,000/21, the provisions on electric vehicle recharging activities were maintained in the current resolution, which seems to indicate no change in Aneel's interpretation on the subject.

It would be possible to argue, therefore, that operation of recharging electric vehicles does not represent marketing and sale of a commodity (in this case, electric energy), since it only aims to offer optimized recharging of the vehicle. Electricity is used as an input for a recharging service, not as a commodity in itself.

However, considering the perspective that recharging of vehicles represents a service, the list of services attached to Complementary Law 116/03 is not clear enough as to the qualification of this activity for ISS taxation purposes and the form of taxation (the tax calculation basis).

Specifically as to the form of taxation, we recall that the only item on the list of services attached to Complementary Law 116/03 that refers to the "loading and reloading" of vehicles (item 14.01) excluded the "parts and pieces used" from the municipal tax assessment, which would be subject to the ICMS.

The absence of an express provision on energy (which would not be a part and piece) in the ISS legislation could be considered by the states as permission for the ICMS to be levied on the amount of electricity used in the recharge, even if the recharge activity is considered a service.

However, it seems to us that electric energy could not be considered a part or piece used in the recharging of electric vehicles, since it is not part of the car, much less indivisible from it - so much so that the recharging is consumed integrally with the use of the vehicle.

The very nature of electricity - as the movement of electric charges resulting from the existence of a potential difference between two points - prevents it from assuming the appearance of a part or piece, since it has no material aspect.

Although the value of the energy has already been taxed by the ICMS when it is acquired by the charging station, this same value could be understood as a cost of providing the recharge service and, consequently, included in the calculation basis of the ISS. As the municipal tax legislation did not expressly intend to cover recharging of electric vehicles, there is a risk that the ISS tax basis would be unduly broadened to also include the values of the energy used in recharging.

Even if the charging station is not considered an electricity trader for regulatory purposes, one cannot rule out the possibility that the state treasury departments will consider these operations to be a type of supply of electricity, directly taxable by the ICMS.

Even if the state tax authorities have this claim, it does not seem to us that there is an ICMS taxable basis. Let us explain: when the electric station recharges the vehicle, the recharge value (P) will be priced based on the sum of the amount paid for the electric energy consumed by the recharging point (E) and the remuneration for the service provided (S).

As is known, the value "E" was taxed by the ICMS when the electricity was supplied by the distribution company or when the energy was contracted with the generating/trading company in ACL. With regard to the supply of this energy in the recharge, there is no surcharge on the purchase price of the electricity by the charging station. Thus, there would be no ICMS taxable amount on the energy used in the recharge.

The only remaining controversy regarding any ICMS taxation would be regarding the "S" value, since Complementary Law 87/96 provides in its article 13, paragraph 1, II, that all "other amounts paid, received, or debited" in the context of the paid circulation of goods are integrated into the ICMS tax basis. There is therefore a risk that states would consider the remuneration fee for the recharging service (S) as part of the ICMS tax basis.

However, it does not seem possible to accept the levy of ICMS on the "S" value, since the recent Complementary Law 194/22 - in addition to establishing the essential nature of electricity, fuels, communication services, and public transportation for purposes of defining the applicable ICMS rates - expressly provided for non-assessment of the ICMS on "transmission and distribution services and industry charges related to electricity transactions," as provided for in the new subsection X added to article 3 of Complementary Law 87/96.

Among these services and charges now exempt from the ICMS are included the Tariff for the Use of the Electricity Transmission System (TUST) and the Distribution System Use Tariff (TUSD).[1]

In a systematic and analogical interpretation of the new subsection X added to article 3 of Complementary Law 87/96, the amounts charged for recharging electric vehicles (S) must also be covered by the same device, since they constitute an amount paid in consideration for a service of distribution/supply of electricity by the charging stations.

In addition, Precedent 391 of the Superior Court of Appeals (STJ) provides that "[t]he ICMS is levied on the value of the electricity tariff corresponding to the power demand actually used.” If the charging station represents an electricity consumer unit, ICMS taxation on the electricity consumed could occur only when it is purchased by the charging station, and there is no possibility for subsequent levying of a state tax on the fee charged for the recharging service (S).

Considering the vagueness of the current tax scenario regarding electric vehicle recharging activity, we believe that legislative changes will be necessary to better accommodate these operations, guaranteeing greater legal security to the market players. The sectors related to electrified means of transportation have been speaking out about the lack of a legal framework and infrastructure, according to a recent report in Valor.

It is necessary that the various incentives that have been granted for the industrialization and sale of electric vehicles be accompanied by a better definition in the tax field of the electric vehicle charging activities. Thus, it seems to us that the issue will still be subject to extensive and considerable discussion, until it is sufficiently tackled and settled by the tax authorities.

[1] The inclusion of the Tariff for the Use of the Electricity Transmission System (TUST) and the Electricity Distribution System Use Tariff (TUSD) in the ICMS tax basis is subject to the STJ's Repetitive Topic 986, which is awaiting judgment by the First Section of the Court. With Complementary Law 194/22, however, we believe that this judicial discussion is substantively moot.