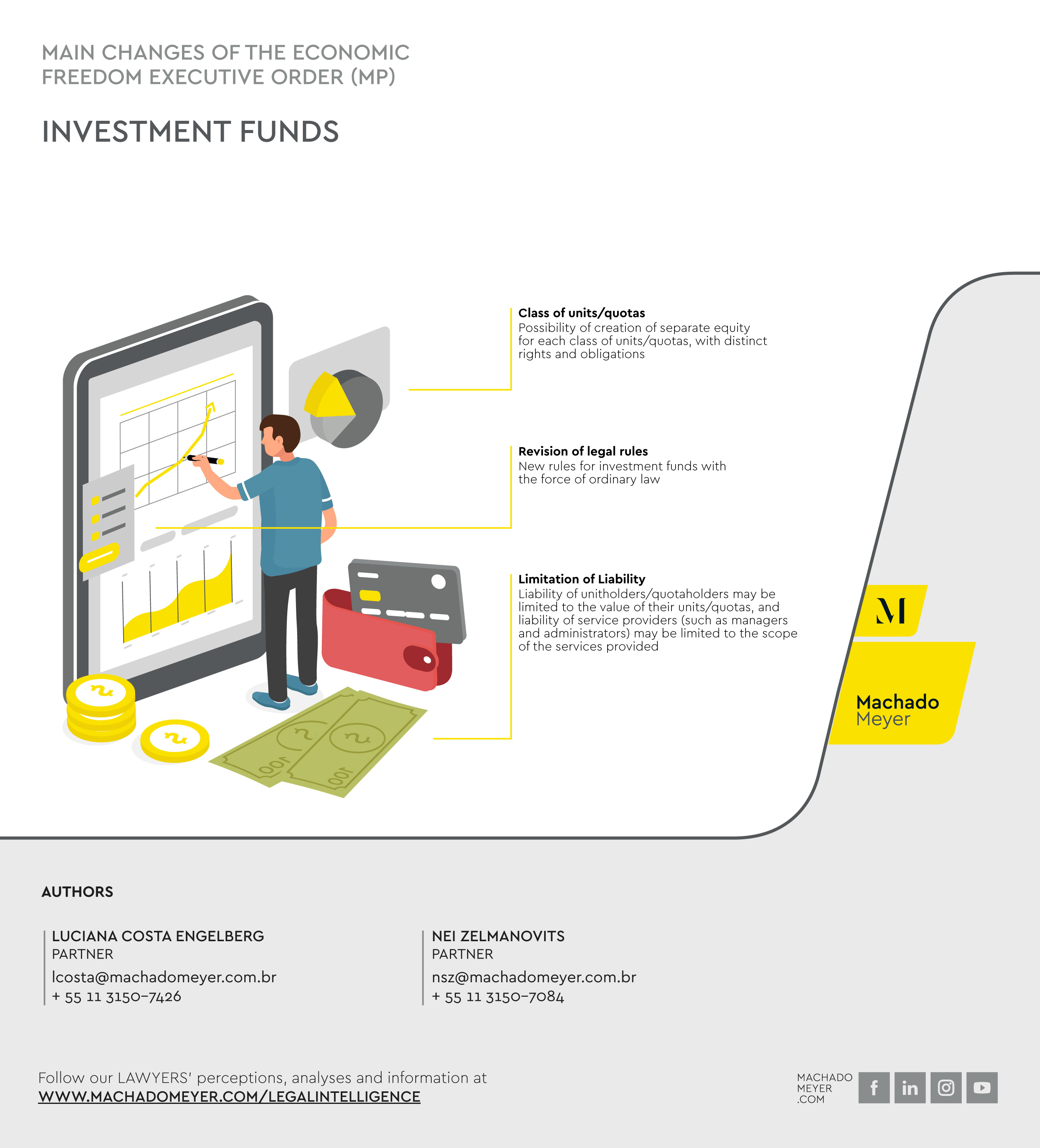

Investment Funds

On September 20, 2019, Federal Law No. 13,874/19 was enacted, setting forth the Declaration of Rights of Economic Freedom. Among the changes promoted by the new law, we highlight innovations for the investment fund industry, with the introduction of a new chapter in the Brazilian Civil Code on the subject (articles 1,368-C to 1,368-F).

The law defined investment funds as a condominium of a special nature, intended for investment in financial assets, property, and rights of any nature, having expressly excluded the application to investment funds of the rules related to condominiums in general provided for in articles 1,314 to 1,358-A of the Civil Code, an understanding that had been adopted by the industry until recently.

The removal of the application of the rules dealing with condominiums in general is in line with the changes brought about by the law regarding the possibility of limitation of the liability of investment fund unitholders. This is so because, according to the interpretation of the general rules on condominiums (and applied to investment funds), unitholders should have unlimited liability for the obligations undertaken by the investment fund (which does not have corporate existence). In that respect, article 15 of CVM Instruction No. 555, of December 17, 2014 (“CVM Instruction 555”), provides that unitholders are liable for any negative equity of the fund.

In addition, Law No. 13,874/19 confirmed the jurisdiction of the Brazilian Securities and Exchange Commission (CVM) to regulate investment funds defined by law and the changes brought in by the new law.

Below we highlight the main aspects of Law No. 13,874/19 dealing with investment funds.

Recording

Pursuant to the third paragraph of the new article 1,368-C of the Civil Code, the recording of investment funds’ bylaws with the CVM is a condition sufficient to ensure their publicity and effectiveness vis-à-vis third parties.

With this change, it will no longer be necessary to record the bylaws of investment funds with a register of deeds and documents, as was previously provided for in CVM regulations.

This was the first issue to be regulated by CVM since the promulgation of Law No. 13,874/19. On October 2, 2019, CVM issued CVM Instruction No. 615, which amends several Instructions issued by the CVM, so as to revoke the requirement of a certificate of recording of an investment fund’s bylaws with the register of deeds and documents.

The change meets the demands of the industry for reducing paperwork and costs.

Limitation of liability of unitholders and unit classes

In line with protecting investors and limiting their liability with respect to the obligations of the investment fund, Law No. 13,874/19 innovated by providing that a fund's bylaws may provide for a limitation on the liability of investors to the value of their units, thereby protecting investors from being liable for obligations of the fund that exceed their holding in the fund.

Also, the bylaws may establish unit classes with distinct rights and obligations, with the possibility of setting up segregated equity for each class, and such segregated equity will only be liable for obligations linked to the respective class, under the terms of the bylaws.

Please note that the adoption of the principle of limited liability by an investment fund originally formed without a limitation is possible but in this case the limitation will only cover events taking place after the respective change in its bylaws. That is, until the matter is regulated by the CVM and the fund's bylaws are amended so as to include a limitation of liability, unitholders will be liable, in proportion to their holding, for the fund's obligations regarding facts that occurred prior to the amendment of the bylaws.

Currently, CVM regulations applicable to private equity investment funds (CVM Instruction 578 of August 30, 2016) allow, in certain situations, for the fund's bylaws to assign to one or more classes of units different economic and financial rights. As a general rule, the different economic rights of the unit classes are limited to the fixing of administration and management fees and order of preference in the payment of income, amortization, or liquidation balance of the fund. In turn, for funds intended exclusively for professional investors[1] or those receiving direct financial support from funding organizations, it is permitted to assign one or more different classes of units economic rights different from those provided for above.

Until the enactment of Law No. 13,874/19, however, there was no specific provision regarding the possibility of setting up segregated equity for each class of unit and limitation of liability of the unitholder for the obligations linked to the respective class. This is one of the major advances the new law brings to the fund industry, which not only allows for cost savings (often via the choice of new fund structures for each investment strategy), but also greater legal certainty for to investors.

It is worth noting that the limitation of unitholder liability and segregation of fund assets by different unit classes are still subject to CVM regulations.

Bankruptcy System

Also in the context of the unitholders' limitation of liability, Law No. 13,874/19 provides that investment funds are directly liable for the legal and contractual obligations assumed by them, and if the limited liability fund does not have sufficient equity to settle its debts, the insolvency rules contained in articles 955 to 965 of the Civil Code shall apply.

Insolvency may be requested in court by creditors, per a resolution by the investment fund's unitholders, pursuant to its bylaws, or by the CVM itself.

The new article 1,368-E of the Civil Code also provides that service providers of the investment fund are not liable for the fund's obligations (except for the losses they cause when they act under willful misconduct or bad faith).

Thus, any liability of the fund could not directly affect the equity of the unitholders, nor the service providers of the fund, as it is mandatory to follow the bankruptcy process for the fund if it does not have sufficient equity to settle its debts.

The table below summarizes the main aspects of the bankruptcy system provided for in the Civil Code:

|

Rules of the bankruptcy system |

|

|

Declaration of Bankruptcy |

Bankruptcy is declared whenever debts exceed the amount of the debtor's assets. |

|

Preferences |

ü If there is no legal title to preference, creditors shall have equal rights over the assets of the common debtor. ü Legal titles to preferences are in rem privileges and rights. ü In rem claims have preference over in personam of any kind; in personam claims have preference over simple claims; and special privileges are over general ones. ü When two or more creditors of the same specially privileged class compete for the same assets, and with like title, there shall be a pro rata apportionment among them in proportion to the value of the respective claims, if the result is not sufficient for the full payment of all of them. ü The special privilege includes only the assets subject, by express provision of law, to the payment of the claim which it favors; and the general privilege includes all assets not subject to in rem claim or special privilege. |

The application of the new bankruptcy rules to investment funds is also subject to regulations in due time by the CVM.

Liability of service providers

In addition to limiting the liability of unitholders, Law No. 13,874/19 contemplates the possibility of limiting the liability of investment fund service providers to the fulfillment of their particular duties, without joint and several liability.

Currently, CVM Instruction 555 and CVM Instruction 578 provide for joint and several liability between the fund manager and third parties hired by the fund for any losses caused to unitholders as a result of conduct contrary to law, regulation, or normative acts issued by the CVM. The regulations applicable to receivables investment funds (FIDC) and real estate investment funds (FII), on the other hand, have no such provision, such that for FIDCs and FIIs it would already be possible to apply the limitation of liability provided for in Law No. 13,874/19.

Conclusions

The changes brought about by Law No. 13,874/19 are an important milestone in the evolution of the fund industry in Brazil, aiming at reducing bureaucracy, costs, and greater investor security, bringing the industry closer to practices adopted in other jurisdictions.

However, changes to the new law are still subject to CVM regulations for their effective application. In this context, the CVM will submit for public hearing an instruction to amend the current regulations in accordance with the provisions of the new law.

[1] Per the terms of article 9-A of CVM Instruction Instruction No. 539, of November 13, 2013, the following are considered professional investors:

I - financial institutions and other institutions authorized to operate by the Central Bank of Brazil;

II - insurance companies and capitalization companies;

III - open-ended and closed-ended supplementary private pension entities;

IV - individuals or legal entities who have financial investments in the amount of more than ten million Brazilian Reais (R$ 10,000,000.00) and, in addition, attest in writing to their status as a professional investor through a separate instrument, in accordance with Exhibit 9-A;

V - investment funds;

VI - investment clubs, provided they have a portfolio managed by a securities portfolio manager authorized by the CVM;

VII - independent investment agents, portfolio managers, analysts, and securities consultants authorized by the CVM, in relation to their own funds;

VIII - non-resident investors.