The Central Bank of Brazil (BC) and the National Monetary Council (CMN) issued, in early May, rules governing the use of book-entry trade notes in order to provide more security for financial institutions to use bills to offer credit.

Following the trend of dematerialization of financial assets and securities[1] seen in the Brazilian market in recent decades, the new rules face the issue at two levels:

- CMN Resolution No. 4,815 deals with financing transactions based on book-entry trade notes; and

- BC Circular No. 4,016 regulates the bookkeeping activity of these securities, creating a series of rules aimed at providing greater security for their issuance, registration, settlement, and trading.

More specifically, CMN Resolution No. 4,815 regulates market receivables discounting operations carried out by financial institutions and loans guaranteed by those receivables.

The main change brought about by the rule for these transactions was the mandatory use of registered and book-entry trade notes under BC Circular No. 4016. According to article 4 of the resolution, financial institutions should require their counterparts, in particular forward sellers who wishes to accelerate their receivables, to issue book-entry trade notes in sales or services.

The trade notes issued or receivables to be created in the future (in the case of so-called "smoke credits”), the institutions to which payments will be made, and the conditions for release of funds paid by debtors of the trade notes, in the case of loans guaranteed by such securities should also be specified via contract (article 5).

Also according to the resolution, the commands in the registration systems or centralized deposit in which the trade notes will be registered must be made by the creditor financial institution (article 6), including exchange of ownership and creation and cancelation of liens and encumbrances.

BC Circular No. 4,016, in turn, provides the necessary support for trading with electronic trade notes to grow in scale, without prejudice to security for the parties and the financial system as a whole. For this purpose, the agents responsible for operating the electronic bookkeeping systems (bookkeepers) must obtain prior authorization from the BC (article 11) and ensure that, concerning trade notes, such systems allow (article 3):

- the performance of all appropriate acts of exchange;

- control of payments;

- trading and exchange of ownership, registration, and centralized deposit in systems authorized to operate by the BC;

- input of encumbrances and lines on trade notes in such systems;

- input of information regarding the transactions carried out, issuance of statements; and

- interoperability with other systems of the same nature.

In a complementary manner, such agents must also observe a series of minimum service and governance standards, including the creation of internal risk management policies, the performance of services with minimum operational reliability, and care for the quality of information recorded in conducting the activity, among other requirements provided for in article 7 of BC Circular No. 4,016.

Also, emphasis should be placed on[2] the provisions of BC Circular No. 4,016 which require association between the trade notes and the respective electronic invoice by the bookkeeper (article 3, sole paragraph) and registration of the trade note in a system for registration or centralized deposit authorized by the BC that interoperates with the others (articles 14 and 19). These requirements are seen as important tools to prevent fraud that was considered an obstacle to the development of this market, such as the issuance of "cold" or duplicate trade notes.

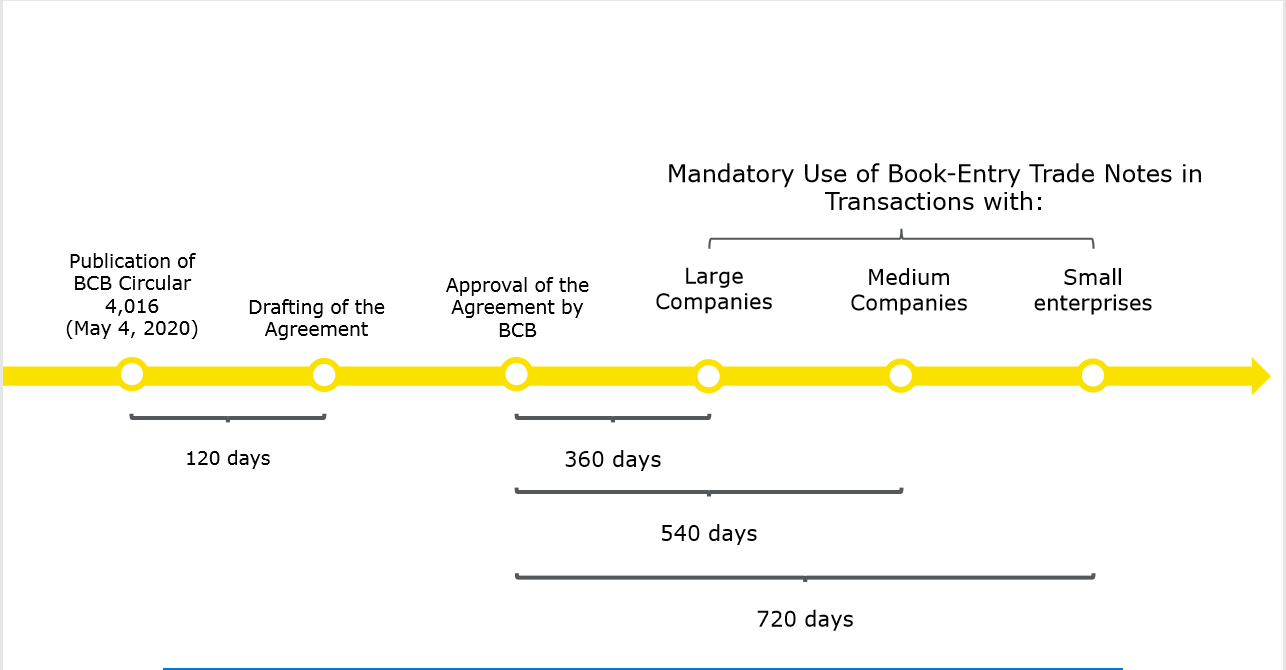

Considering the technical challenge represented by the implementation of these new systems, the mandatory issuance of book-entry trade notes for the negotiation of commercial receivables by financial institutions will only become effective after approval of the agreement between registrars and depositories provided for in BC Circular No. 4,016 and within deadlines that vary according to the size of the clients financed, as shown in the figure below (article 3 of CMN Resolution No. 4,815):

The system of book-entry trade notes established by BC Circular No. 4,016 and CMN Resolution No. 4,815 represents an effort to give this market security and robustness in the bookkeeping infrastructure already established by the national regulatory framework for other financial assets and securities. Figures such as bookkeeping agents, registration and centralized deposit systems, settling banks, and supervision closest to the BC itself may be new to the trade notes market in particular, but the fact is that this model and its effectiveness and solidity are already widely known by the financial market and its clients in general.

At the same time, applying these new rules to a segment as traditional as trade notes, with their own vices and virtues, may lead to the emergence of a set of new challenges, particularly cultural adaptation. Add to this the current unprecedented crisis resulting from the covid-19 pandemic, which makes it even more difficult to implement a technologically complex process.

In fact, security and predictability have their cost. But what is perhaps seen today as another concern by many can easily become a source of new opportunities. With significant adherence by financial institutions to loans and financing backed by book-entry trade notes, many companies will be able to access new, cheaper forms of credit. In addition, another opportunity is created for financial asset registrars. The financial market and its infrastructure providers therefore have the mission of adapting to this new regulatory reality and of seeking to achieve the objectives expected of them, which can certainly contribute to the resumption of economic development in Brazil.

[1] A more complete description of this process can be found in WELLISCH, Julya. “Títulos Nominativos: da Cártula ao Depósito Centralizado” [“Registered Securities: from Card System to Centralized Deposit”]. In: Revista de Direito Bancário e do Mercado de Capitais [“Review of Banking and Capital Markets Law”], vol. 66/2014, pp. 35-62.

[2] Other noteworthy provisions in the circular are the rules on the security of financial settlements relating to the payment of trade notes (Chapter III, Section II), minimum information to be made available to drawees (article 6), duties of the registration and centralized deposit systems (Chapter VI, Section I), and the execution of an agreement among the entities that manage them, which shall be prepared with the participation of the BC and deal with operational issues such as layouts and informational content of the files, procedures, times of exchange of information, fees, among others (article 20).