In the midst of the serious coronavirus pandemic that is worsening the reality of the population of the state of Rio de Janeiro, Governor Wilson Witzel issued Decree No. 47,057/20 on May 5 to regulate the charging of a new levy to be borne by companies in Rio de Janeiro.

The decree now requires payment into the state coffers of the equivalent of 10% of the tax benefits granted by the state to ICMS taxpayers (Tax on Circulation of Goods and Services).

The discrepancy of this charge which, among other ills, seeks to revoke tax benefits granted for a fixed term and under onerous conditions, will certainly be the subject of intense debate in the case law. However, what is most surprising in the measure is the indifference with which the state government treats the serious economic crisis caused by the pandemic.

The OECD (Organization for Economic Cooperation and Development) recommendations to avoid increased levies during the pandemic, mainly through the institution of new taxes, do not seem to find a voice in the Rio de Janeiro government.

As Insper professor Ana Monguilod rightly points out, "the message from the OECD is that states need to adopt measures to give breath, lifelines for businesses to survive and maintain jobs.”

The important measures adopted by the State of Rio de Janeiro to contain and confront the pandemic are not denied. However, it is not untimely to remember the constraining financial situation of the Rio de Janeiro business community which, for the time being, does not have any sign of when it can return to its full operational activities.

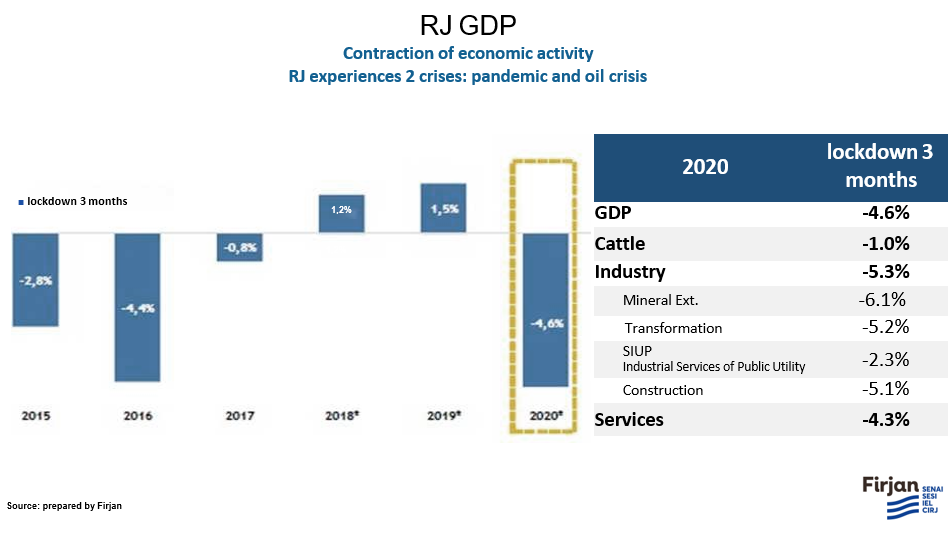

Data collected by Firjan already estimate an economic deficit in 2020 equivalent to 4.6% of the GDP of the state of Rio de Janeiro:

Faced with this delicate context, it would be good if the Rio authorities had the sensitivity to rethink as soon as possible the levying of this new tax on the already shaken and recovering business community in the state.