Bruno Racy, Roberto Kerr Cavalcante Bonometti and Frederico Antelo

The agribusiness sector and financing alternatives for the agribusiness chain have been the subject of important changes and improvements in the last year. The conversion of Executive Order No. 897/19 (the Agro MP) into Law No. 13,986/20 brought about various innovations aimed at stimulating access to credit, especially through capital market funding. Among them, the following stand out:

- the establishment of the Solidarity Guarantee Fund;

- the creation of collateralized rural assets;

- the institution of the Rural Real Estate Note (CIR);

- the expansion of the parties authorized to issue Rural Product Notes (CPR) to include rural producers (whether individuals or legal entities), cooperatives, and associations of producers that act in the production, marketing, and industrialization of rural products, as well as the possibility of indexing the security to exchange rate variation; and

- the possibility of creating and executing real guarantees on rural properties, including through payment in kind or otherwise.

These advances have had a strong effect on the Agribusiness Receivables Certificate (CRA) market, which has been very heated in the last year. According to Anbima data (Brazilian Association of Financial and Capital Markets Entities), in 2020, 586 issuances were conducted for public distribution of CRA, totaling approximately R$ 95.8 billion. This corresponds to a 31% increase in the volume of issuances and a 21% increase in the number compared to 2019.

CRAs are fixed income securities issued by a securitizer and backed by receivables originating from business between farmers, or their cooperatives, and third parties. These businesses include financing or loans related to the production, marketing, processing, or industrialization of products, agricultural supplies, or machinery and implements used in agricultural production, as provided for in Article 23, paragraph 1 of Law No. 11,076/04.

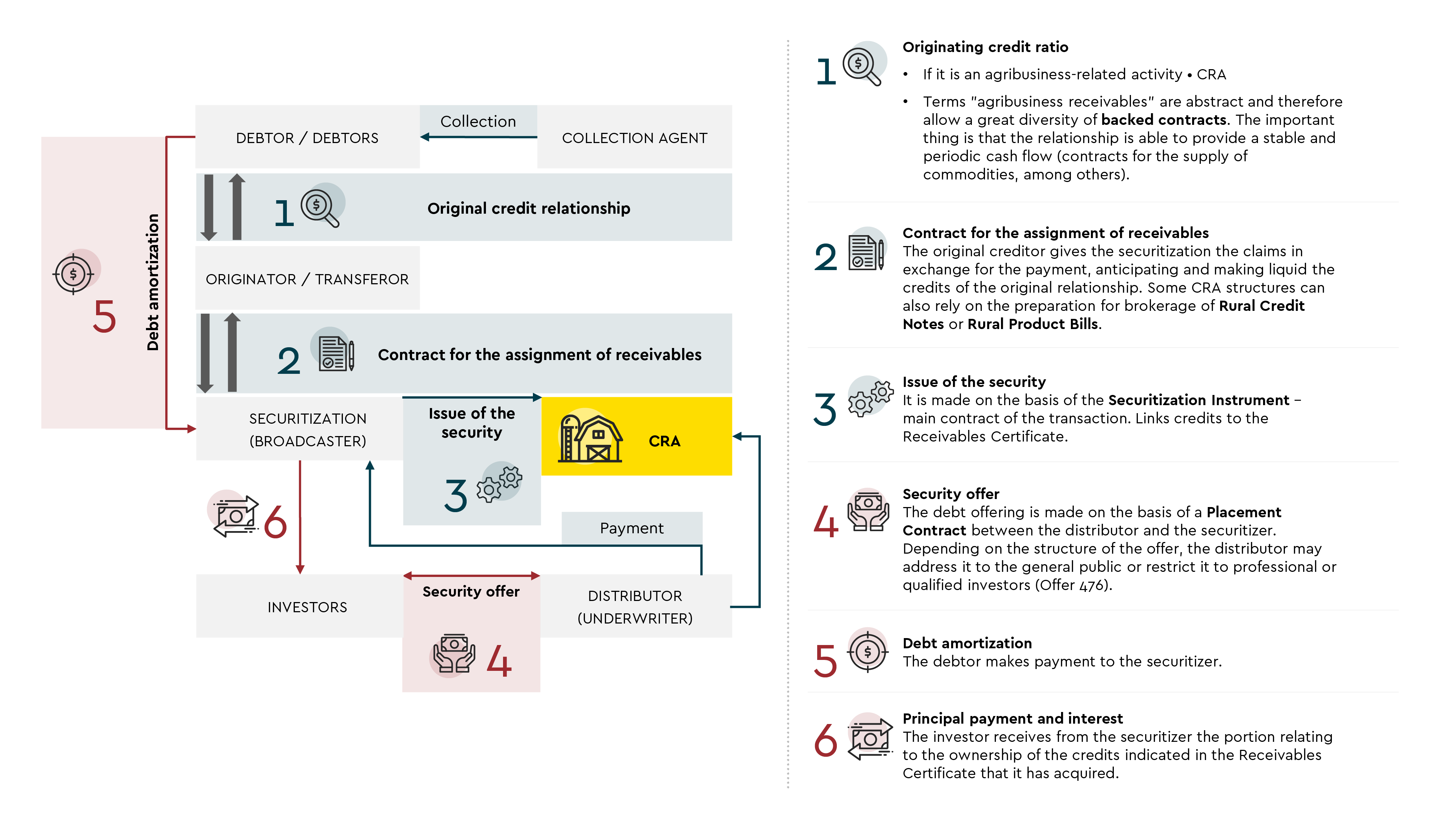

The diagram below summarizes the structure of a CRA issuance:

Article 3, paragraph 4, of CVM Instruction No. 600 establishes that receivables rights may be considered to back (or securitize) an offer of CRA when created: (i) directly by debtors or original creditors characterized as rural producers or their cooperatives, regardless of the destination to be given by the debtor or the transferor to the funds; or (ii) debt securities issued by third parties linked to a commercial relationship between the third party and rural producers or their cooperatives; or (iii) debt securities issued by farmers or their cooperatives. This provision of CVM Instruction No. 600 reflects various CVM precedents regarding Law No. 11,076/04, through which the interpretation of credits that may contain CRA offers, including those that are at the end of the agribusiness production chain, has been expanded.

In addition to the nature indicated above, these receivables rights can be used in various ways, such as trade acceptance bills, Rural Product Notes (CPR), Promissory Notes (NP), Agribusiness Credit Rights Certificates (CDCA), debentures, Export Credit Notes (NCE), Export Credit Bills (CCE), Supply Contracts or Rural Real Estate Notes (CIR).

The CRAs market tends to become even more attractive to investors after the creation of CRA Garantido [Collateralized CRA] on April 8. It is a new product through which the National Bank for Economic and Social Development (BNDES) will act as a guarantor for investors in a CRA issuance.

The operation that inaugurated this product was the issuance of CRA from Ecoagro – a securitization firm specialized in agribusiness – based on receivables rights of Cotrijal Cooperativa Agropecuária e Industrial, with 7,700 more cooperative members.

In the case of the issuance announced, BNDES guaranteed only the CRAs of the first series (through an endorsement of the bank), which will be considered senior in relation to the CRAs of the other series, so that they will have priority (a) in receiving the remuneration; (b) in payments arising from extraordinary amortization and/or early redemption, as the case may be; (c) in the payment of the unit par value; and (d) in the event of separate equity settlement.

In the event of late payment, non-compliance with obligations, and/or if it is necessary to re-compute the escrow accounts in which the agribusiness receivables rights that backed the issuance are deposited, the fiduciary agent (as a representative of the holders of the CRAs of the first series) or the issuer may notify BNDES to make payment of the principal and interest due.

Bndes' intention with this new product is to guarantee the payment of the securities to investors and, with this, to promote access to the capital markets by small and medium-sized rural producers. With the unprecedented participation of BNDES as guarantor in the scope of CRA offers, the expectation is that this measure will result in:

- reduction in the financial costs of operations for rural producers and/or their cooperatives, since the guarantee given by BNDES mitigates the risk of default and, consequently, allows allocation of lower interest to the securities;

- greater security for those who invest in CRAs and, consequently, more interest in these securities, since, unlike LCAs (another fixed income instrument used to regulate exposure to the agribusiness sector), CRAs are not guaranteed by the Credit Guarantee Fund;

- complementing the alternative sources of financing for rural producers, or cooperatives, with more incentive to raise money in the capital market outside the traditional financial system; and

- stricter compliance with social and environmental standards, since it is a fundamental requirement for BNDES’

In line with the growing support of investors and funders for ESG analyses, another strategy to further increase the attractiveness of CRAs is the possibility of obtaining environmental and social certifications, such as green bonds or social bonds. In such cases, CRAs undergo a certification process by entities such as the Climate Bonds Initiative (CBI), which establish the criteria for issuing these certifications. By attracting investors who would not initially be interested and increasing demand for such securities, these certifications may also lead to reduced financial costs for the operation.

The constant growth of agribusiness, driven, among other factors, by the various forms of stimulus given to the sector, and now added to BNDES' performance as guarantor and the possibility of certification of CRAs as green bonds, makes the option of financing through these securities an increasingly interesting alternative for rural producers, as such structures tend to attract more investors.